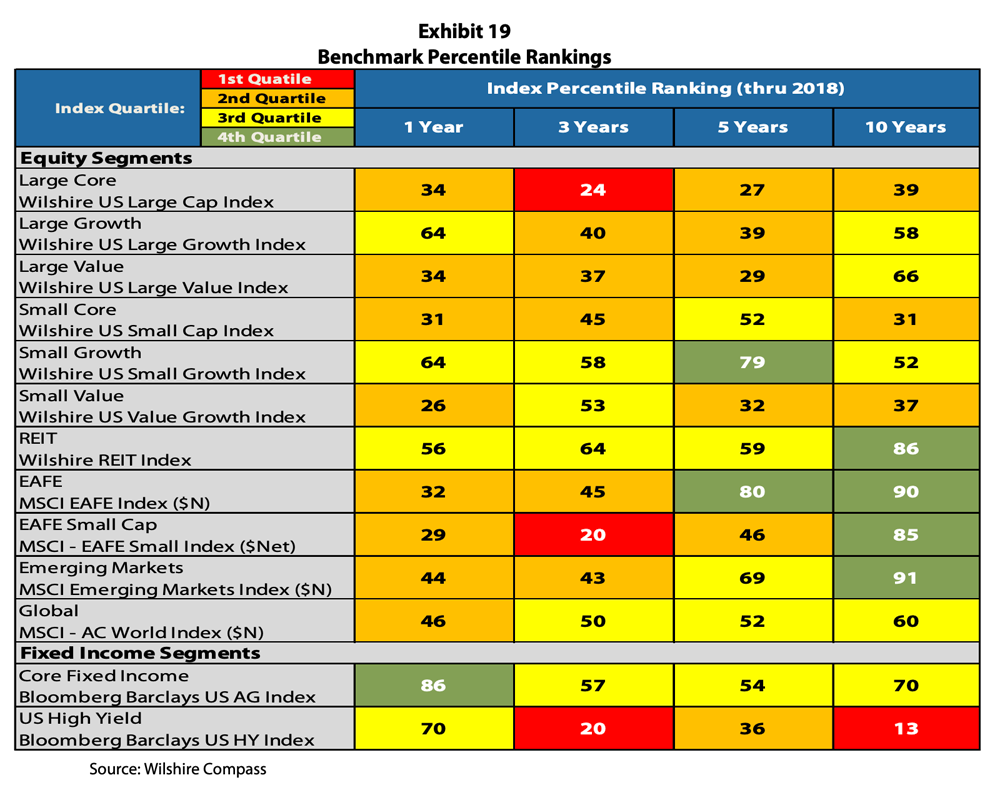

Frequently, comparisons of active and passive management focus on US Large Cap, which provides only a partial picture of the value active management plays in diversified portfolio. Offering a refreshingly comprehensive view on the performance of active managers, a recent report from Wilshire, 2018 Active Management Review, provides an assessment of active management in a number of asset classes and across one-, three-, five-, and ten-year horizons. The data shows that over the past decade, active management, gross of fees, outperforms in 9 of 13 strategies, with Emerging Markets, Core US Fixed Income and REITS leading the way:

Green indicates that a high proportion of managers were able to outperform the relevant benchmark, and red the opposite. According to the authors, all returns used throughout the analysis reflect gross-of-fee returns. That decision was made in order to allow for a more direct comparison of performance across investment products within a specific universe.

Green indicates that a high proportion of managers were able to outperform the relevant benchmark, and red the opposite. According to the authors, all returns used throughout the analysis reflect gross-of-fee returns. That decision was made in order to allow for a more direct comparison of performance across investment products within a specific universe.

Manager highlights from the study included:

- Emerging Markets Equity managers as a group have delivered strong relative performance over the past ten years, with average and median returns of 1.87% and 1.79% versus the MSCI Emerging Markets Index.

- An impressive 91% of managers in the EM universe have outperformed the index over the latest ten-year period.

- Within the US Equity universe, Large and Small Growth managers delivered strong relative performance in 2018 with median excess gross-of-fee returns of:

- +3.06% for Small Growth

- +1.91 for Large Growth

- Fixed Income Universes: Both fixed income universes posted positive median gross-of-fee excess returns in 2018, with high yield managers delivering particularly strong relative results.

- +1.33% USHighYield

- +0.65% USCore

The Wilshire authors suggest that performance consistency is achievable, but that “the successful use of active management cannot solely rely on picking past winners. Extracting long-term value from an active management program requires robust qualitative analysis to properly inform the interpretation of quantitative results.”

These conclusions align with research and thought leadership the Active Managers Council has curated that affirms active managers add value. A sampling of this content includes:

Please visit the Council’s Research & Thought Leadership section to review a growing library of content on active management.