What We’re Reading Now: ETF Execs Suggest “Everyone Is Active”; US News Argues for Active and Passive; and MFS Examines Market Cycles

Periodically on this blog we share a collection of some of the articles we’re reading that speak to the active and passive conversation, and that help to propel the dialog. Here’s a selection of recent articles we find helpful to the discussion.

“Is This Fund Active or Passive? ETF Execs on What Divides the Two”

“Blurred lines” is how executives at the Inside ETF conference earlier this year chose to describe the development of factor-based active and “smart-beta” index ETFs; products which have effectively muddied the traditional lines separating active and passive strategies.

When asked to define an active versus a passive ETF, several industry executives at the conference used phrases like, “Everyone is active, actually.” Or “Everything can be as active or passive as you want.”

Greg Friedman, Head of ETF Management and Strategy at Fidelity indicates, “active is, what's my outcome? I want an outcome to either be a solution — for example yield, low volatility, that's an active thought,” said Friedman. “You can use different instruments to get that. It could be accessed return as well. So I think we've made the lines artificially hard to say one is passive, one is active. Everything can be active. And you can use different types of instruments to get that active perspective.”

“Active vs. Passive Investing: Which to Use and When”

“The debate between active vs passive management isn't one of absolutes,” writes US News & World Report. The article solely focuses on when to deploy active and passive while reinforcing the industry viewpoint that investors should use both.

"Active versus passive investing strategies have often been framed as an all or nothing proposition," says Kent Insley, chief investment officer at Tiedemann Advisors in New York. But this needn't be the case. "We believe that combining active and passive management is the best way to construct a portfolio, focusing active strategies in areas where they are most likely to succeed."

US News & World Report makes the case for the value of both, noting that while passive index funds do offer exposure to a variety of markets, there remain many markets and strategies for which there is no investable passive index and where passive investing isn’t the best alternative. Classes like fixed income or international markets present viable opportunities for active investors.

Active managers have the benefit of better mitigating risk, where passive investors “are at the mercy of the index: When it's up, they're up; but when it's down, they're just as far down.” Active managers, the author writes, “can shelter their investors from some of that downside with more strategic investment selection. The flip side to that is you may not rise as high as the index either. Such is the price of having a smoother ride.”

MFS: Active Management Bears Watching

This brief article from MFS Investment Management, which can be found on the AMC’s Thought Leadership page, serves as a good reminder that investors would be well-served to view the active/passive conversation over full market cycles (bull AND bear phases), and that investors need to be prepared for both.

Ravi Venkataraman, CFA, Global Head of Investment Solutions for MFS writes: “The data suggests that alpha opportunities appear cyclical in nature, with active managers able to thrive during periods of high volatility and dispersion in equity prices, conditions that often accompany market downturns, but struggle during periods of low volatility and little dispersion. History shows that outperformance in tumultuous markets can set investors up for solid returns over the long term and can prevent a whole host of well-known behavioral mistakes brought on by volatility.”

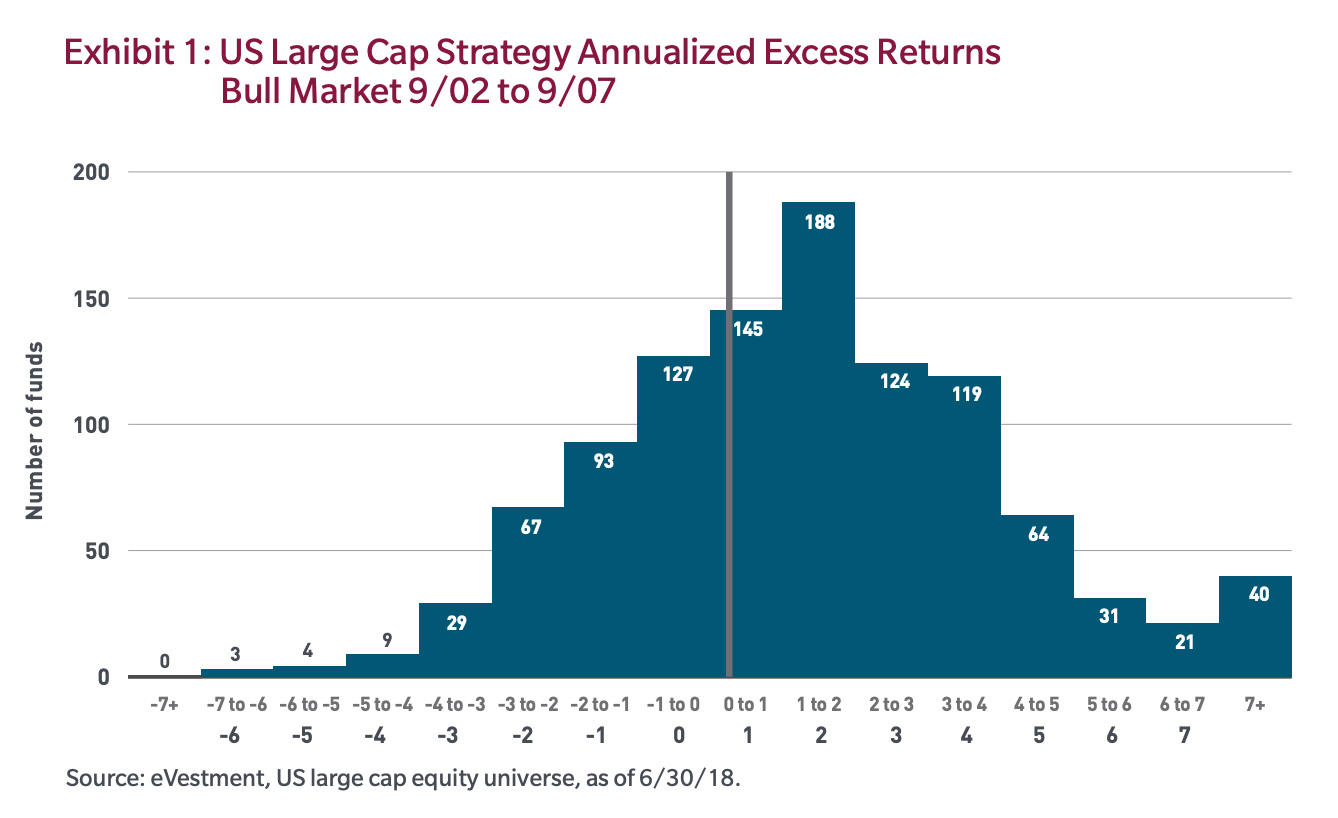

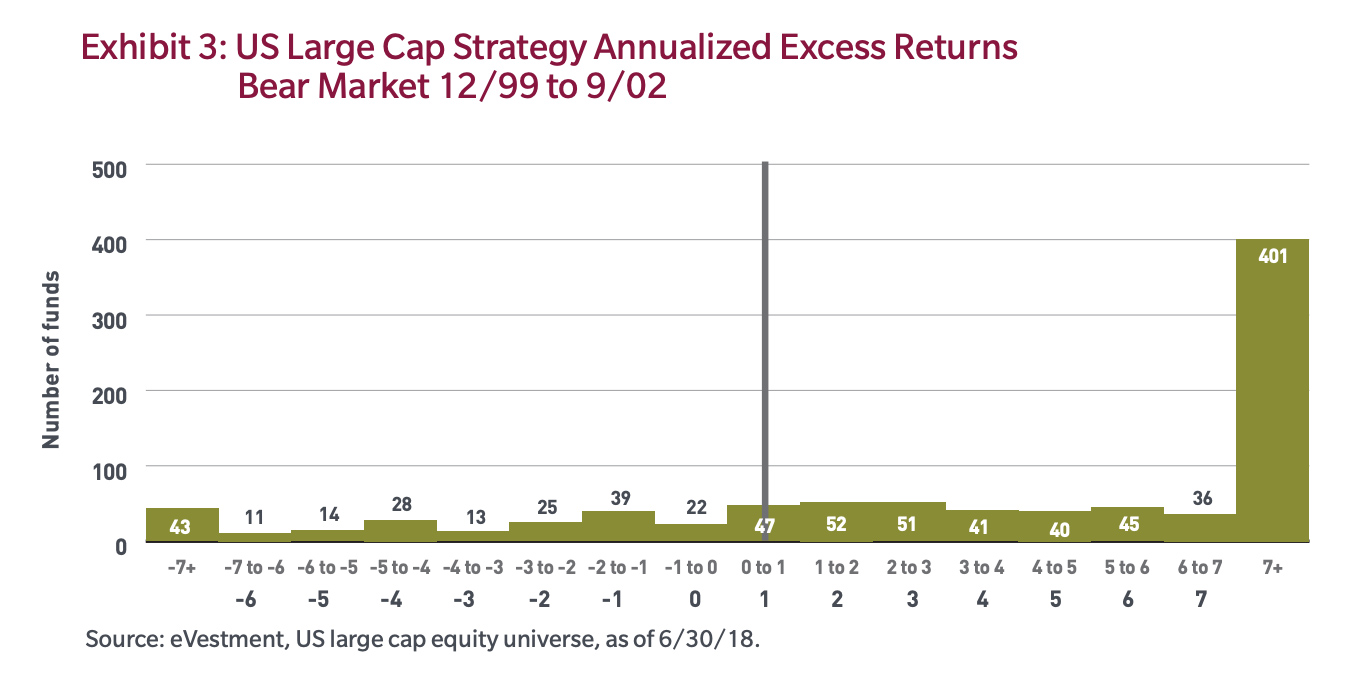

Venkataraman looked at the two most recent market cycles and segmented them into the bull and bear phases. His findings? Manager returns appeared to follow different return distributions, “whereby the group exhibits a bell-shaped pattern during bull markets but a positively skewed pattern during bear markets.”

During the bull market period from September 2002 to September 2007, the distribution of annualized excess returns appears somewhat normal, distributed with returns clustered around the market rate of return (see Exhibit 1).

The performance of active managers in the two most recent bear market periods paints an entirely different picture, writes Venkataraman. As a group, more active managers delivered significant excess returns. Indeed, during the bear market that followed the bursting of the dot-com bubble (from December 1999 to September 2002), the vast majority of active managers in the large-cap universe outperformed the S&P 500 Index by in excess of 7% on an annualized basis, as illustrated in Exhibit 3.

During the bear market that ushered in the global financial crisis (September 2007 to March 2009), active managers again added significant alpha.

For more insight please visit the Council’s Research & Thought Leadership section to review a growing library of content on active management.