Active managers: Market turmoil provides opportunities to shine – Pensions & Investments

Active equity managers buy growth and value, or so reports Pensions & Investments. “Despite growth managers' performance edge in the tumultuous prior quarter, active value-oriented managers aren't idle.”

Regardless of style, the current market volatility presents a challenge, but also opportunity for active managers.

"The path forward has so many rabbit holes that it's hard to predict when the market will hit bottom and recovery will begin, but significant volatility allows active managers to take advantage now of dislocations," said Christopher M. Riley, partner and head of global equity research at Aon Hewitt Investments USA Inc., Chicago.

"In the ashes and smoke, we are seeing some active U.S. equity managers that are producing really great returns so far this year by buying securities of high-quality companies with valuations that have sharply declined,” Mr. Riley said.

He continues, "Being nimble shows how active managers create good long-term value during a period of disruptions. We are seeing strong performance so far this year among active managers investing in some pockets in the market. Relative to passive management, some of these managers look pretty good."

Don’t reallocate from active to passive in a downturn – StyleAnalytics Blog

While people focus on keeping themselves and their families safe during the COVID-19 pandemic, some are ensuring their portfolios are just as safe. As such, StyleAnalytics has taken a closer look at the performance of active versus passive during various market downturns. Their conclusion: “quality active managers significantly beat the broad market in down months and especially in the worst four market crises over the past twenty-five years.”

Their analysis shows that quality active managers not only beat passive investment during downturns, but that the outperformance grows with larger market losses. Additional findings via StyleAnalytics’ blog include:

Average Outperformance During Each of Last Four Crises

Focusing on just the crises, StyleAnalytics measured the average monthly underperformance/ overperformance of the five percentile categories, shown in Figure 2 below. Of the four crises studied, the Tech Bubble had the largest outperformance by managers, likely because its epicenter was an easily identifiable and ‘hedgeable’ industry. Each of the other crises shows a consistent outperformance of over 40 bps per month for the top 25th percentile and well over 140 bps per month for the top 5th percentile.

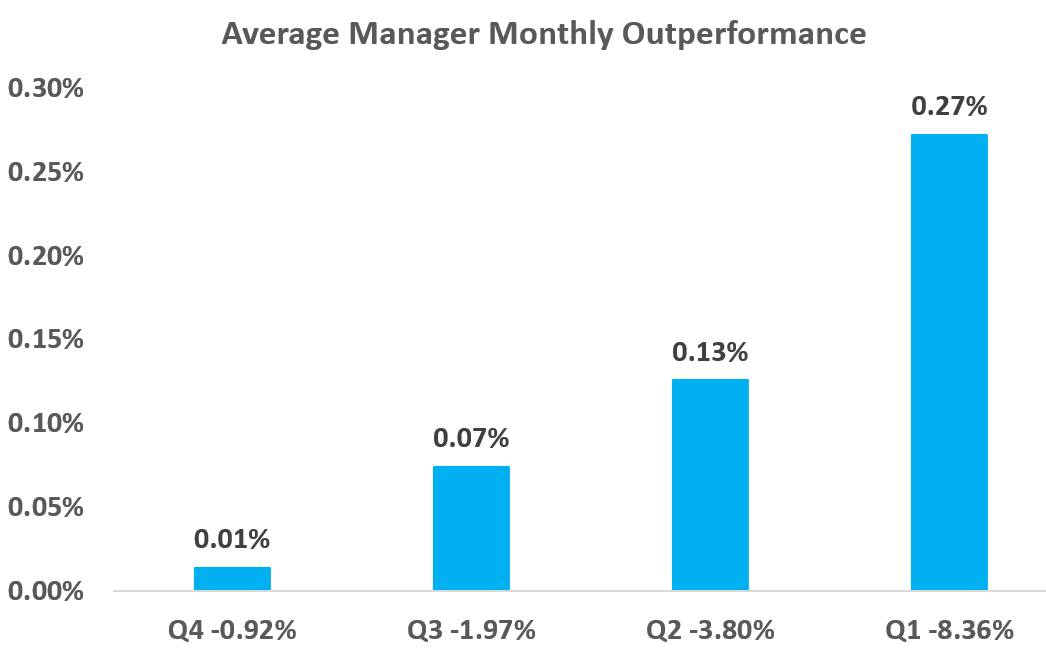

Average Manager Monthly Outperformance

The below chart organized the overall active manager outperformance of the Russell 1000 into four quartiles to demonstrate that the outperformance of the average active manager increases with severity of downturn. During the most severe downturns, active managers as a group provide market outperformance of almost 30bps per month.

As the COVID-19 pandemic causes significant disruption in global markets, the temptation to reallocate from active to passive should be tempered by the realization that active management often provides a level of downside protection not observed in core passive investments.