A new report from the Active Managers Council illustrates that sustainable investing inherently involves active decision-making. Take for example the dispersion of sustainability ratings.

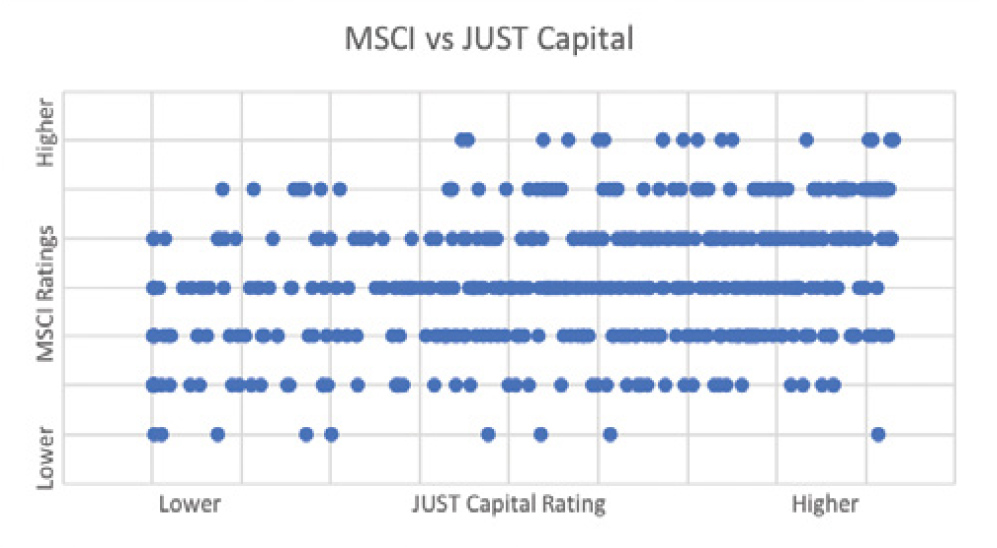

The paper found that ratings from different providers can seem to have little connection with each other, as the below scatter diagram illustrates. It plots MSCI ESG ratings of 518 companies against ratings for the same companies from JUST Capital.

Data: MSCI and JUST Capital ratings available online on May 28-29, 2020.

Data: MSCI and JUST Capital ratings available online on May 28-29, 2020.

The most compelling evidence for the subjective nature of the ESG investment process is the dispersion of the sustainability ratings used in this index-based approach. If the ratings process was 100% objective, all of the ratings systems should generate similar scores for the same companies.

However, those scores can differ significantly. The ratings on automaker General Motors are a case in point. In May 2020, ratings provider JUST Capital ranked GM as #1 in the “automobile and parts” industry and within the top 2% of all 922 companies that it rates. By contrast, according to ratings provider MSCI, GM is a “laggard” in its industry, earning the lowest grade of CCC.

Tesla, is perhaps a more popular example. As the Financial Times reported in May, “The electric carmaker is rated in the bottom 10 per cent of all companies by one rating agency (JUST Capital) but receives an “A” grade from another (MSCI). It is easy to see how investors looking at this might be left scratching their head. But, conversely, many people in the sustainable investing market argue that having this kind of access to a variety of opinions from different experts can be a good thing and help them make better informed decisions.”

In Tesla’s case, the difference comes down to how heavily JUST Capital weighs Tesla’s record on worker’s rights and MSCI’s decision to attach more importance to the company’s environmental impact.

Sustainability ratings can provide insights and, as a result, can serve as a useful starting point for a securities selection process. In fact, active managers often use these ratings to narrow down the candidates for future research or help identifying industries or companies that present higher risk. However, active managers perform in-depth research to validate the insights provided by the ratings before making security selection decisions.