Broadridge Research: Active Asset Managers Can Meet Rising Demand with New ESG Solutions

A new report from Broadridge Financial Solutions suggests that “many aspects of ESG investing lend themselves to active approaches” including the management of non-transparent risks, the ability to reduce or eliminate holdings, and identifying forward-looking opportunities when outcomes cannot be detected easily with current and historical data.

This tracks with findings from a recent paper, “Sustainable Investing is an Active Process” from the Active Managers Council. The paper explores this topic in great detail, arguing that the traditional fully active approach allows for a more nuanced consideration of a wider range of quantitative and qualitative factors, which helps investors tailor their portfolios to their sustainability goals.

Most important, sustainable investing isn’t ‘set it and forget it.’ The materiality of sustainability issues is changing constantly. Ultimately, the paper finds that active managers can help investors stay on top of these changes and achieve their long-term goals.

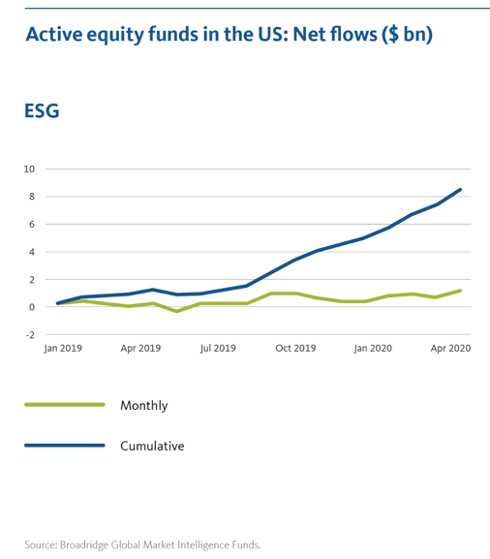

The Broadridge report reveals a growing investor demand for active managers to introduce new environmental, social and governance (ESG) funds to the market. Global assets in ESG mutual funds and exchange-traded funds have more than doubled in the past five years to $1.3 trillion in June.

“Despite the rising popularity of index funds, ESG represents one of the most attractive segments for active fund managers,” Broadridge said in the report. Eighty-one percent of assets overseen by European ESG funds are actively managed, compared to 68 percent for the U.S. In addition, flows into ESG active equity funds during the trailing 12 months reached 15% of average assets in Europe and International cross-border markets, and 10% in the U.S.

Active management matches clients to the right ESG funds

Bruce Jenkyn-Jones, co-manager of the Impax Environmental Markets investment trust, said in a recent article in Financial Times Adviser that, “investing with an active fund manager is the key to being able to avoid stocks that are mispriced.”

“Active managers seek to get underneath the skin of a company to work out what is really going on behind the scenes. It is also important to look at the ESG activities of these companies in detail and ask yourself how they are integrating ESG risk considerations into their practices.”

And what of ESG performance during the pandemic? Early indications are that ESG portfolios have fared better than conventional portfolios during the pandemic and are attracting record levels of cash as they have proved they can offer comparable returns.

Figures from Morningstar show that sustainable funds recorded inflows of $71.1bn in the second quarter, sharply contrasting with the general equity outflows seen over the past year.

Will this new focus on sustainable issues lead to “increased adoption of socially responsible investing and prove to be a major turning point for ESG”?

Mike Myers, investment manager and head of socially responsible investing at Punter Southall Wealth says thematic managers who generate ideas by evaluating global megatrends and identifying long-term structural growth themes have a greater advantage identifying opportunities.

He adds: “Another significant aspect is the fund manager’s ability to interpret and digest the non-financial factors relating to the underlying investment and how they make their own assessment on the ESG credentials of the potential investment.

“Allocating to managers with different but complementary approaches will aid diversification, mitigate concentration risk and ultimately achieve a better outcome for the client.”

With all the hype surrounding ESG, there is growing concern that some funds have been overbought.