“Active management is almost synonymous with ESG,” says Jay Horgen, President and CEO of AMG. The opportunity for active managers with respect to sustainable investing is the focus of this issue of What We’re Reading Now. We also look at the growth in active ETFs.

Affiliated Managers Group’s latest affiliate acquisition of Parnassus, a leader in sustainable investing, illustrates the emphasis institutions are placing on the inherently active nature of ESG investing.

According to a paper released this month by Casey Quirk, there is opportunity for active management to capture share from indexed strategies in the rapidly growing market for sustainable investing.

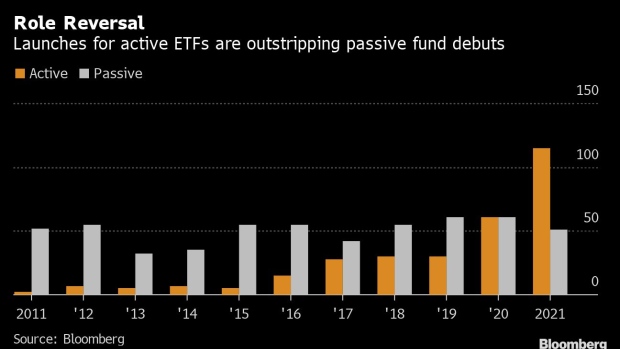

On the ETF-front, active investing continues to gain in popularity. Data compiled by Bloomberg shows that exchange-traded fund issuers have this year launched 115 active products versus just 51 passive funds.

Let’s look at some of the headlines.

AMG CEO on Parnassus Deal: ‘Active Management is Almost Synonymous With ESG’ – Institutional Investor

This month, Affiliated Managers Group (AMG) and Parnassus Investments reached an agreement whereby AMG would take a majority stake in the investment firm. With $47 billion in assets, Parnassus is one of the longest running U.S. firms in ESG. According to Institutional Investor, Parnassus is AMG’s third affiliate manager focused exclusively on ESG.

AMG is betting that ESG will ultimately be dominated by active managers.

“We believe that active management will take the leading role in ESG.” Jay Horgen, President and CEO of AMG said that’s because there’s not enough historical and other data on ESG to successfully backtest quantitative and other models of investing.

“Active management is almost synonymous with ESG,” he said.

Dedicated sustainable assets headed for $13 trillion by 2025: Casey Quirk – Pensions & Investments

According to a paper released earlier this month by Casey Quirk, the estimated $13 trillion of dedicated sustainable investing assets would represent about 12% of total assets under management by 2025, compared with 3.4% by the end of 2020.

Prompting the growth is retail investor demand, increased sustainability disclosure and market regulation, and widespread adoption by institutional asset owners and financial intermediaries.

Alyssa Buttermark, lead ESG analyst for Casey Quirk and co-author of the paper, titled –- It's Not Easy Being Green: Managing authentic transformation within sustainable investing – indicates “the opportunity is there for active management to capture market share from indexed strategies and reap considerable economic rewards if firm leaders can commit and execute on plans to retool with credible sustainable investing processes.”

Passive-Investing World Turned Upside Down as Active Funds Boom – Bloomberg

Bloomberg reported in June on the growth of actively managed ETFs. In just the first six months of the year issuers have launched 115 active products compared with just 51 passive funds.

Touting this growth as “a comeback of sorts for stock pickers,” BNN Bloomberg attributes this rise in popularity to a combination of new rules and the enduring attractiveness of ETFs with investors. A slow but major shift is underway, writes BNN Bloomberg.

Bloomberg writes: Active funds remain a small slice of the ETF industry, and their assets make up just 3.4% of the overall ETF market. But that’s up from 2.7% a year ago. And in a sign the trend could continue, several large Wall Street firms who long held out against ETFs are now embracing them.